We’ve all worked extremely hard – pushed to get one more sale; got that product over the line; secured another client contract – and expect to be rewarded correspondingly. Yet frequently we are disappointed when we receive a seemingly enormous tax bill.

So how can you optimise your tax bill?

First, let’s look at your salary. If you are a small business owner, or a contractor running your limited company, you have flexibility in the amount of salary and dividend that you pay yourself. Importantly, you are not constrained to pay yourself a minimum wage as would be the case if you were paying other staff. This is important because you have to pay employer National Insurance Contribution (NIC) once your salary is over £175 per week (equivalent to £758 per month, £9,100 per annum).

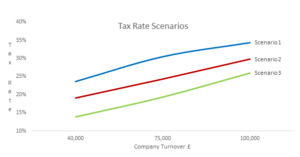

The graph below shows three different scenarios of tax rates at various turnover level.

- Scenario 1 – salary at minimum wage, and some NIC. Highest tax rate.

- Scenario 2 – salary just at NIC threshold, no NIC paid.

- Scenario 3 – salary just at NIC threshold, no NIC paid, plus pension contribution for yourself.

Please note that this illustration applies to owner directors, and minimum expense is considered. The absolute tax rates will be lower once you factor in expenses, but the trend will remain the same. Tax rate is the overall tax paid as percentage of company turnover.

Another factor might come in play and distort the view – employment allowance. It is £5,000 per annum towards your class 1 employer NIC. Companies with one owner director is not eligible for the allowance, but companies with two or more owner directors or hiring staff are. However, even when the employer NIC is “free” (covered by employment allowance), you still need to pay the employee NIC. The end result is still less favourable than lower salary and no NIC.

The simple conclusions are: a) The more you earn, the higher tax rate you are subject to, b) your tax rate will increase once the salary goes over the NIC threshold, c) pension contribution will reduce overall tax rate.

How can pension contribution reduce your tax bill? Although owner directors are exempt from the auto-enrolment, it is not a bad idea to put some money away towards your pension. You have to have a valid company pension scheme set up in order to make the contribution, and the maximum you can contribute is your salary, provided you have not reached the £1m life-time allowance. So if you take out £9,1000 in salary, and put the same amount into pension, this will reduce your overall tax rate. Although it does reduce your take home pay by £3,600, this is the most tax efficient way to pay yourself – you forgo the £3,600 now to be able to put £9,100 away for future.